RSA: Mid-year Submission

You may access the PAYE Business Requirements Specification on the SARS website for more details of what is mentioned below.

New IRP5 Codes

This is any payment/benefit received from a COVID-19 disaster relief organisation and paid to an employee.

This code is ONLY applicable for the 2021 Year of Assessment.

This code must NOT be used for benefits received from the UIF Temporary Employees Relief Scheme (UIF TERS).

IRP5 Code 3724 is only available on Earning Definitions and is:

-

Not Taxable

-

Included for UIF

-

Excluded for SDL

-

Included for ETI Remuneration

-

May be selected for RFI

-

Included in the Tax Deductible limit remuneration amount

In the previous release, if an employee received a payment from a ‘Covid-19 disaster relief organisation’, you would have processed it either against IRP5 code 3602 or 3608, as set out in the example below:

Main Menu > Payroll > Definitions > Earnings Definitions

PLEASE NOTE:

If you used IRP5 code 3602, no UIF has been calculated on these values in the prior months and it was not included in ETI remuneration (if applicable) for previous months. It is strongly recommended that you contact your Business Partner consultant to assist you with corrections to the UIF calculations/submissions and ETI corrections (if applicable).

Before you process your IRP5 mid-year submissions, you must change the IRP5 Code to 3724.

You can select ‘Yes’ for RFI.

This isCovid-19 Solidarity Fund donations deducted from the employee’s remuneration and paid by the employer to the Solidarity Fund.

This code is ONLY applicable for the 2021 Year of Assessment.

This is a tax-deductible deduction which is subject to the limits listed below.

A maximum donation to be allowed as a deduction by the employer when calculating the monthly PAYE is a percentage of the employee’s remuneration after deducting allowable retirement fund contributions over specific months.

-

33.33% for 3 months (April, May and June 2020)

-

16.66% for 6 months (April to September 2020)

It is the user’s responsibility to calculate the correct limit/s and apply it in the system.

SARS has clarified that code 4030 (employee donations) should include donations made to Covid-19 disaster relief organisations, but exclude donations made to the Solidarity Fund and donations made to the solidarity fund must be reported separately against IRP5 code 4055.

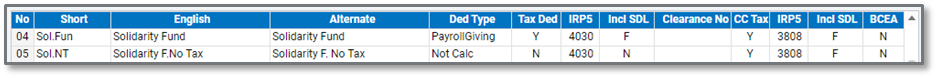

In a previous release, we suggested that in the interim, you define a deduction line for ‘Solidarity Fund' as set out in the example below:

Main Menu > Payroll > Definitions > Deduction Definitions

If the employee wanted to contribute more to the fund, than what is allowed as tax deductible, create a separate deduction line, for the Not Tax-deductible portion.

Before you process your IRP5 mid-year submissions, you must change the IRP5 Code from 4030 to 4055.

You must select ‘Full’ for SDL.

PLEASE NOTE:

The full value entered on this deduction line (Tax Ded =’Y’), will be tax deductible.

Therefore, it is YOUR responsibility to ensure that the deduction value is within the limits, because the full value processed on this line will be included as a tax deduction in the tax calculation.

Annuity from a Provident/Provident Preservation Fund is any qualifying annuity paid on a regular basis from a provident or provident preservation fund as well as backdated provident or qualifying annuity (from a provident or provident preservation fund).

IRP5 Code 3618 is available on the Earning Definitions, Company Contribution Definitions, Calculation Screen Definitions and Own Definitions and is:

-

Fully Taxable

-

Excluded for UIF

-

Excluded for SDL

-

Included for ETI Remuneration

-

May be selected for RFI

TERS payments are exempt from taxable income in terms of section 10(1)(mB) of the Income Tax Act (i.e. not subject to PAYE, UIF, SDL etc.).

The PAGSA has confirmation from SARS that no IRP5 code should be used for TERS payments.

As stated in a previous release, if TERS was/is paid to you, the employer, to pay to your employees, you are simply acting as a paying agent, therefore, it was/is not mandatory to process the TERS payment through the payroll, but could have/can be done through the payroll for payment, reporting and record keeping purposes.

Below is an example of the Earning setup on the Payroll system if the TERS payment was/is processed through the payroll.

Amended ETI Code Validations

The values can only be 0, 1, 2 or 3:

0 - if the employee does not qualify for ETI for the specified month;

1 - if the employee qualifies for ETI for the specified month and the specified month is in the first 12-month period

2 - if the employee qualifies for ETI for the specified month and the specified month is in the second 12-month period

3 - if the employee qualifies for additional ETI (increased ETI due to COVID19). This will be for the additional employees who qualify for ETI (employees aged 30 – 65, employees employed before 1

October 2013 and employees who have already qualified for 24 months).

If the Year of Assessment is 2021, then special rules apply if the month is 04, 05, 06, or 07, to accommodate the additional ETI relief.

Please refer to SARS_PAYE_BRS - PAYE Employer Reconciliation_V19 4 for more details.